People seem to just lose it whenever the Amex Starwood Preferred Guest credit card comes with an increased sign-up bonus, such as the 35k offer currently available until early April.

At first glance, you might notice that the sign-up bonus on the SPG card is quite low compared to other credit card offers out there.

After all, there are many other credit cards that come with 80k, 100k, or even 150k sign-up bonuses. So why should we all go nuts when SPG raises their sign-up bonus to a measly 35,000 points?

Is 35,000 SPG Points an Amazing Offer?

Well, for one, it’s the highest sign-up bonus they’ve ever offered on the card, though the minimum spending requirement might be a little bit higher as well.

At the moment, American Express is offering an increased 35,000 Starpoints when you spend $5,000 in the first six months of account opening.

Broken down, it’s 25,000 Starpoints when you spend $3,000 in the first three months, and an additional 10,000 Starpoints if you can muster another $2,000 within the first six months.

The offer is only available until April 5th, 2017, meaning you have to make a decision in the next couple months if you haven’t taken advantage before.

Assuming you spend the required total of $5,000, you’ll wind up with 40,000 Starpoints, which is apparently pretty good for this lucrative credit card currency.

The sign-up bonus is usually only 25,000 points, so you’re getting a big bump on a percentage increase basis (40% bump to be exact), though it’s only another 10k points.

However, these points can go pretty far, or at least further than other award currencies, such as Membership Rewards and Ultimate Rewards.

One Redemption Idea for 40,000 Starpoints

For example, you get a transfer rate of 1:3 from SPG to Marriott, which is now owned by Starwood. So those 40,000 Starpoints equate to 120,000 Marriott Rewards points.

That’s well above the 80,000 Marriott Rewards points you can earn through the Marriott Rewards Premier Credit Card from Chase, or the business version of the card. Both would only net you 83,000 points after spending the required $3,000 in the first three months.

So we know right there that SPG points are indeed a valuable currency. And if you happen to have Chase Ultimate Rewards points lying around, you can get 5 free nights at a category 8 Marriott hotel, such as the beautifully updated Wailea Beach Resort in Maui.

Hotels in category 8 will set you back 40,000 Marriott points per night, but if you book four consecutive nights, you get the fifth night free.

In other words, if you have 40,000 Ultimate Rewards points that you can transfer over to Marriott along with your 40,000 Starpoints, you’ll wind up with 160,000 Marriott points.

Hello free vacation in Maui for five nights! And you only burned through 40,000 UR points in the process, which isn’t bad seeing that Chase is constantly throwing 100k and 80k offers our way.

Starpoint Airline Transfer Bonus

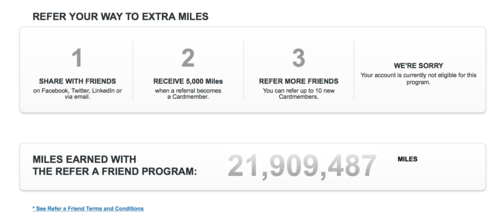

Another special benefit to Starpoints is the transfer bonus they enjoy when sent to participating frequent flyer programs. For every 20,000 you transfer, you get a 5,000 bonus, all year-round.

Put simply, 20,000 Starpoints equals 25,000 frequent flyer miles – oh, and they have the most airline partners of any credit card issuer, including some carriers that require very few miles to go long distances.

What’s special about the 35k bonus offer is the fact that you get 40k Starpoints after spending the required $5,000, which is enough for two 20k transfers to airlines.

If you transfer all 40,000 Starpoints earned via the 35k sign-up bonus offer, you’ll get 50,000 frequent flyer miles.

Typically, you’d have 30,000 Starpoints and you could transfer 20k for a 5k bonus, but then you’d only have 10k remaining, which wouldn’t receive the 25% bonus (has to be 20k increments).

Actually, you can get even more miles than that if there happens to be an SPG transfer bonus going on. One recent example was American Airlines providing a 20% transfer bonus.

That meant you could transfer 20,000 Starpoints to AA and receive the standard 5,000 transfer bonus, plus another 20% bonus on top of that, for an additional 5,000 AA miles.

All said, you’d get 30,000 AA miles for the price of 20,000 Starpoints. If you transferred all 40,000 Starpoints, you’d get 60,000 AA miles.

As you can see, the value of the SPG bonus can be a lot better than it looks once you factor in all the special perks of Starpoints.

Aside from frequent flyer and hotel transfers, you can always use the Starpoints for Starwood hotel stays as well, with some good value depending on the category. Certain developing countries have low-category hotels that are still quite nice, and you can use the cash & points option to stretch your points even more.

The icing on the cake is the fact that the annual fee of $95 is waived on the card the first year, meaning you might be able to get 60,000 frequent flyer miles without paying a dime in credit card fees. And the spending requirement is pretty reasonable.

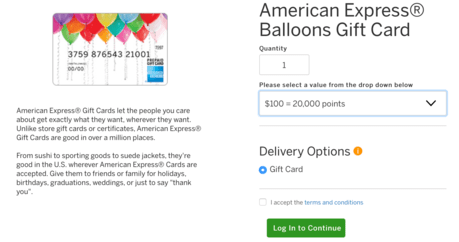

You just have to be smart with redemptions, and avoid options that don’t maximize the value of these special points.

Pro tip: Don’t transfer Starpoints to airline partners that offer a less than 1:1 ratio, including United, Air New Zealand, GOL Airlines, and LATAM Airlines.

(photo: Matt@PEK)