Credit cards offer a number of perks to their cardholders, from mega sign-up bonuses to 0% APR to free lounge access to annual travel credits. Additionally, some don’t charge foreign transaction fees.

Let’s focus on that last benefit so you can quickly determine which credit card to use while traveling abroad to avoid any unwelcome fees on your many non-cash purchases.

Credit card issuers generally charge 3% of the transaction if/when traveling outside the USA, meaning $30 per $1,000 in spending. With so many cards waiving these fees, you might as well carry the right card the next time you leave America.

Below we have grouped credit cards that don’t charge foreign transaction fees by issuer – we also note whether they charge an annual fee or not. This is helpful if you want a card for the long-haul, one that you don’t have to pay for to keep in your wallet year after year.

Credit Cards with No Foreign Transaction Fees

| Issuer | Card Name | Annual Fee | Where Accepted |

| Amex | Platinum | $450 | Hit or miss |

| Amex | Biz Platinum | $450 | Hit or miss |

| Amex | Centurion | $2,500 | Hit or miss |

| Amex | Gold | $160 | Hit or miss |

| Amex | Biz Gold | $175 | Hit or miss |

| Amex | Premier Gold | $195 | Hit or miss |

| Amex | SPG | $95 | Hit or miss |

| Amex | SPG Biz | $95 | Hit or miss |

| Amex | Gold Delta | $95 | Hit or miss |

| Amex | Gold Delta Biz | $95 | Hit or miss |

| Amex | Platinum Delta | $195 | Hit or miss |

| Amex | Plat Delta Biz | $195 | Hit or miss |

| Amex | Delta Reserve | $450 | Hit or miss |

| Amex | Plum Card | $250 | Hit or miss |

| BofA | AAA Member Rewards | $0 | Anywhere Visa |

| BofA | Alaska Signature | $75 | Anywhere Visa |

| BofA | Alaska Biz | $75 | Anywhere Visa |

| BofA | Travel Rewards | $0 | Anywhere Visa |

| BofA | Travel Rewards Biz | $0 | Anywhere Visa |

| BofA | Merrill + Visa | $0 | Anywhere Visa |

| BofA | Merrill Biz | $0 | Anywhere Visa |

| BofA | Virgin Atlantic | $90 | Anywhere MC |

| BankUnited | Bonus Rewards Plus | $50 | Anywhere Visa |

| BankUnited | Travel Rewards Amex | $95 | Hit or miss |

| Barclaycard | Arrival Plus | $89 | Anywhere MC |

| Barclaycard | Arrival Regular | $0 | Anywhere MC |

| Barclaycard | AA Aviator Red | $95 | Anywhere MC |

| Barclaycard | Ring | $0 | Anywhere MC |

| Barclaycard | Carnival | $0 | Anywhere MC |

| Barclaycard | Hawaiian | $89 | Anywhere MC |

| Barclaycard | Holland America | $0 | Anywhere Visa |

| Barclaycard | JetBlue | $0 | Anywhere MC |

| Barclaycard | Lufthansa | $89 | Anywhere MC |

| Barclaycard | Priceline Rewards | $0 | Anywhere Visa |

| Barclaycard | Princess Cruises | $0 | Anywhere Visa |

| Barclaycard | Wyndham Rewards | $0 | Anywhere Visa |

| Barclaycard | Gold Card | $995 | Anywhere MC |

| Barclaycard | Black Card | $495 | Anywhere MC |

| Barclaycard | Titanium Card | $195 | Anywhere MC |

| BBVA | Select Card | $125 | Anywhere Visa |

| BMO Harris | Premium Rewards MC | $79 | Anywhere MC |

| Capital One | ALL CARDS | Various | Anywhere MC/Visa |

| Chase | British Airways | $95 | Anywhere Visa |

| Chase | Fairmont | $95 | Anywhere Visa |

| Chase | IHG | $49 | Anywhere MC |

| Chase | Sapphire Preferred | $95 | Anywhere Visa |

| Chase | Sapphire Reserve | $450 | Anywhere Visa |

| Chase | Hyatt | $75 | Anywhere Visa |

| Chase | Ink Plus | $95 | Anywhere Visa |

| Chase | Ink Preferred | $95 | Anywhere Visa |

| Chase | United MileagePlus | $95 | Anywhere Visa |

| Chase | United Club | $450 | Anywhere Visa |

| Chase | Marriott | $85 | Anywhere Visa |

| Chase | Marriott Biz | $99 | Anywhere Visa |

| Chase | Ritz Carlton | $450 | Anywhere Visa |

| Chase | Amazon Rewards | $0 | Anywhere Visa |

| Chase | Amazon Prime | $0 | Anywhere Visa |

| Chase | Southwest Prem Biz | $99 | Anywhere Visa |

| Chase | United Explorer Biz | $95 | Anywhere Visa |

| Citi | AA Plat Select | $95 | Anywhere MC |

| Citi | AA Exec | $450 | Anywhere MC |

| Citi | AA Biz | $95 | Anywhere MC |

| Citi | ThankYou Prem | $95 | Anywhere MC |

| Citi | Prestige | $450 | Anywhere MC |

| Citi | Expedia Voyager | $95 | Anywhere MC |

| Citi | HHonors Reserve | $95 | Anywhere Visa |

| Citizens Bank | Cash Back Plus World MC | $0 | Anywhere MC |

| City National | Crystal Infinite | $400 | Anywhere Visa |

| Comerica | Visa Bonus Rewards Plus | $50 | Anywhere Visa |

| Comerica | Travel Rewards Amex | $95 | Hit or miss |

| Discover | ALL CARDS | $0 | Anywhere Discover/Diners Club |

| Fifth Third Bank | Trio Card | $0 | Anywhere MC |

| HSBC | Premier World MC | $0 | Anywhere MC |

| HSBC | Advance MC | $0 | Anywhere MC |

| HSBC | Platinum MC Rewards | $0 | Anywhere MC |

| HSBC | Platinum MC | $0 | Anywhere MC |

| Huntington | Voice Card | $0 | Anywhere MC |

| M&T Bank | Visa Signature | $0 | Anywhere Visa |

| PenFed | ALL CARDS | $0 | Anywhere VISA/Amex |

| SunTrust | Cash Rewards | $0 | Anywhere MC/Amex |

| TD Bank | TD Cash | $0 | Anywhere VISA |

| TD Bank | TD First Class | $89 | Anywhere VISA |

| USAA | ALL CARDS | Mostly $0 | Anywhere VISA/Amex |

| US Bank | FlexPerks Gold Amex | $85 | Hit or miss |

| US Bank | FlexPerks Travel | $49 | Anywhere Visa |

| US Bank | SkyPass Visa Signature | $80 | Anywhere Visa |

| Wells Fargo | Propel 365 Amex | $45 | Hit or miss |

| Wells Fargo | Propel World Amex | $175 | Hit or miss |

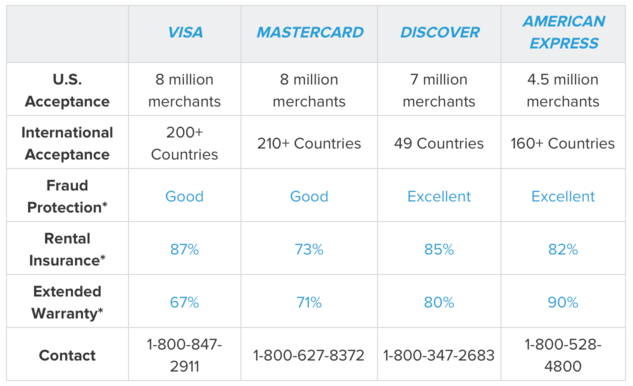

*Credit cards issued by Visa and MasterCard enjoy the best acceptance, whereas those issued by American Express and Discover may not be accepted by as many foreign merchants (or even domestic ones!), hence why we wrote “hit or miss” for Amex cards. Discover seems to be the worst for acceptance outside the U.S.

Also watch out for merchants that allow you to pay for things in U.S. dollars while traveling abroad. You can get hit with a costly foreign currency conversion fee, which is separate from foreign transaction fees!

American Express

While many American Express cards do not charge foreign transaction fees, none offer this perk while charging no annual fee. So you’ll pay for the privilege no matter what. Well, unless the first year’s annual fee is waived…

Additionally, many retailers outside the United States (and inside the U.S. for that matter) don’t actually accept American Express. Think the smaller restaurants, hotels, etc., those that aren’t high-end or big-name world brands.

If your Amex doesn’t waive the foreign transaction fees, expect to pay 2.7% of the transaction, which is slightly lower than the industry standard 3%.

Keep in mind that there are a variety of Amex Platinum cards other than those listed such as ones issued by Ameriprise, Charles Schwab, Mercedes Benz, Morgan Stanley, etc. that waive the fees.

Bank of America

Bank of America offers a couple credit cards that don’t charge foreign transaction fees. And there are two Merrill Lynch cards that don’t charge the fees either. Also, their Business Preferred World MasterCard charge card only charges 2% as opposed to the typical 3%.

Barclaycard

Barclaycard has a good variety of credit cards with no foreign transaction fees, including their popular Arrival Plus card. Additionally, they have quite a few cards that don’t charge forex or annual fees, so you can keep the card long term. All are Visa or MasterCard too.

Capital One

Perhaps the trailblazer of this credit card perk was Capital One, which doesn’t charge foreign transaction fees on any of its credit cards. Even better is that their cards are either Visa or MasterCard, which tend to enjoy the best acceptance rate of any credit card worldwide. They also have many no annual fee options such as Quicksilver, VentureOne Rewards, and their Platinum Card.

Chase

Many Chase credit cards waive the foreign transaction fees, but they often come with annual fees. The two exceptions are the Amazon credit cards from Chase, which both don’t charge annual fees or foreign transaction fees.

Citi

Citi has a handful of credit cards with no foreign transaction fees, but none of them carry no annual fee. So you’ll be paying for the privilege unless the fee is waived during year one. The good news is they’re Visa and MasterCard issued cards.

Discover

The great thing about Discover is they don’t charge foreign transaction fees. The bad news is they aren’t accepted everywhere, notably France, and certainly not as widely as Visa and MasterCard. However, things do seem to be getting better in terms of acceptance rate globally. If you see a Discover or Diners Club International logo, the merchant should take the card.

HSBC

This multinational bank rightly waives foreign transaction fees on many of their credit cards, and you can get a $0 annual fee on many of them as well. Just note that some of the cards require a banking relationship to waive the annual fee.

PenFed

This credit union doesn’t charge any foreign transaction fees on its credit cards, which come in both Visa and American Express varieties. The Visa ones are likely preferred for international travel to ensure acceptance.

USAA

The United Services Automobile Association (USAA) removed foreign transaction fees from all of its credit cards. But they offer both Visa and American Express cards, the latter of which might not accepted by merchants in all foreign countries you visit.

(photo: Charles Clegg)