It’s no secret people like lists. We also like lists. And so we decided to make a big old list of the very best (largest, highest) credit card sign-up bonuses to ever be offered.

That means you’ll see some bonuses that are no longer available, or only available to certain individuals because they’re targeted.

However, our aim in creating this list, which will be maintained over time, is to help you understand the deal in context. Is it something you shouldn’t pass up? Has it been better? Is it likely to improve in the future?

While nothing is ever definite in the credit card game, we at least have something to go on…it might also help you get matched for a particular bonus, assuming the card issuer is feeling particularly warm and fuzzy that day.

It’ll also make shopping for a credit card easier because you can quickly reference the best deal ever and then seek it out to ensure you don’t pass up a better offer. For the record, this is easy to do because credit card issuers often present varying offers to different people, or through different channels. And usually shove the inferior ones down your throat.

So knowing what’s the best out there means you can search for it, ideally find it, or if not, demand it from your card issuer (or wait for it to come back again).

Anyway, enough rambling, let’s talk about the best damn credit card sign-up bonuses in history.

For reference, best is the highest it’s ever been, good is something you probably shouldn’t pass up because it likely won’t get much better (or it’s a targeted offer you’ll never receive), and average is just the no frills, standard bonus you can pretty much always get.

Highest Ever Sign-Up Bonuses by Card Issuer

| Card Issuer |

Card Name |

Best Bonus |

Good Bonus |

Avg. Bonus |

| Amex |

Biz Platinum |

250k points |

100k points |

50k points |

| Amex |

Platinum |

150k points |

100k points |

50k points |

| Amex |

Premier Gold |

75k points |

50k points |

25k points |

| Amex |

Biz Gold |

75k points |

50k points |

50k points |

| Amex |

Gold |

25k points |

25k points |

0 points |

| Amex |

Green |

25k points |

25k points |

0 points |

| Amex |

SPG/SPG Biz |

35k points |

30k points |

25k points |

| Amex |

EveryDay Card |

35k points |

25k points |

10k points |

| Amex |

EveryDay Pref |

50k points |

30k points |

15k points |

| Amex |

Blue Cash Every |

$500 |

$250 |

$100 |

| Amex |

Blue Cash Pref |

$250 |

$250 |

$150 |

| Amex |

Delta Platinum |

70k miles |

60k miles |

35k miles |

| Amex |

Delta Gold |

70k miles |

50k miles |

30k miles |

| Bank of America |

Cash Rewards |

$200 |

$200 |

$100 |

| Bank of America |

Cash Biz MC |

$500 |

$200 |

$200 |

| Bank of America |

Travel Rewards |

20k points |

20k points |

10k points |

| Barclaycard |

Arrival Plus |

50k miles |

40k miles |

40k miles |

| Barclaycard |

CashForward |

$200 |

$200 |

$100 |

| Barclaycard |

Hawaiian |

50k miles |

50k miles |

35k miles |

| Capital One |

Quicksilver |

$200 |

$100 |

$100 |

| Capital One |

Venture |

100k miles |

50k miles |

40k miles |

| Chase |

Ink Cash |

$500 |

$300 |

$200 |

| Chase |

Ink Preferred |

100k points |

80k points |

80k points |

| Chase |

Sapphire Pref |

80k points |

70k points |

60k points |

| Chase |

Sapphire Rez |

100k points |

100k points |

50k points |

| Chase |

Freedom |

$300 |

$200 |

$150 |

| Chase |

Freedom Unl |

$300 |

$300 |

$150 |

| Chase |

Southwest Plus |

50k points |

50k points |

25k points |

| Chase |

Southwest Prem |

50k points |

50k points |

25k points |

| Chase |

Southwest Biz |

70k points |

60k points |

50k points |

| Chase |

Marriott Biz |

100k points |

80k points |

70k points |

| Chase |

Marriott |

100k points |

80k points |

50k points |

| Chase |

United Biz |

70k points |

50k points |

30k points |

| Chase |

United Club |

75k points |

AF waived |

AF waived |

| Chase |

British Airways |

100k Avios |

50k Avios |

50k Avios |

| Citi |

AA Exec |

100k AA points |

50k AA points |

50k AA points |

| Citi |

AA Plat Biz |

50k AA points |

50k AA points |

30k AA points |

| Citi |

AA Plat |

50k AA points |

50k AA points |

30k AA points |

| Citi |

AA Gold |

50k AA points |

50k AA points |

25k AA points |

| Citi |

Prestige |

100k TYP |

60k TYP |

40k TYP |

| Citi |

ThankYou Prem |

60k TYP |

50k TYP |

30k TYP |

| Citi |

ThankYou Pref |

40k TYP |

30k TYP |

15k TYP |

| City National |

Crystal Infinite |

100k points |

70k points |

50k points |

| Discover |

it Card |

$150 |

$100 |

$100 |

| Discover |

it Chrome |

$100 |

$50 |

$50 |

| Discover |

it Miles |

2X miles 1st year |

2X miles 1st year |

2X miles 1st year |

| Merrill Lynch |

Plus Visa |

50k points |

50k points |

50k points |

| Wells Fargo |

Propel World |

40k points |

40k points |

40k points |

| Wells Fargo |

Propel 365 |

20k points |

20k points |

20k points |

*Keep in mind that the highest ever offer doesn’t mean it’s the best offer. There are varying spending requirements for the points/miles/cash back shown. You should also consider the annual fees, which may or may not be waived during year one, along with any statement credits offered.

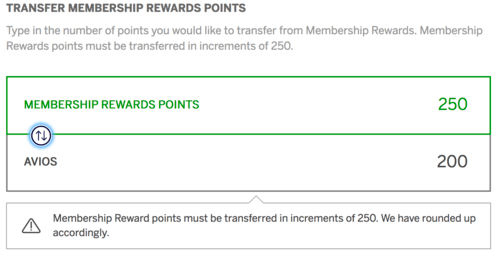

American Express

Amex Business Platinum (250,000 Membership Rewards points) – the caveat with this offer is that you only receive 50,000 MR points after spending $5,000 in the first six months, but an additional 20k points each time you spend $5,000 or more in a single transaction, up to 10x. There’s also a 150k offer that requires $20k in total spending, which is more straightforward.

Source

Source

Amex Platinum (150,000 Membership Rewards points) – Some folks have received a sign-up bonus of 10X on all spending the first year up to 150k points on the personal version of Amex Platinum. That translates to $15k spending for 150k points, which is pretty good. The highest public offer we’ve seen was a 100k sign-up bonus for spending just $3k, which apparently only lasted several hours…you may also be targeted if you’re lucky!

Source

Source

Amex Green Card (25,000 Membership Rewards points) – This is the weakest of the Amex cards, but often it’s offered with no sign-up bonus. So getting 25k for spending $1k ain’t bad.

Source

Amex Premier Rewards Gold (75,000 Membership Rewards points) – This targeted offer apparently only required $1,000 in spending during the first three months, which is pretty phenomenal. And the $175 annual fee was waived!

Source

Amex Business Gold (75,000 Membership Rewards points) – The spending requirement was as low as $5,000 in the first three months, but also as high as $10,000. And the annual fee was waived. Not a bad deal.

Source

Amex Gold/Green (25,000 Membership Rewards points) – The best we’ve seen on both these cards is 25,000 MR points, which isn’t much, but also doesn’t require much spending (typically $1,000) and the annual fee is often waived. Additionally, Amex often offers zero sign-up bonus…

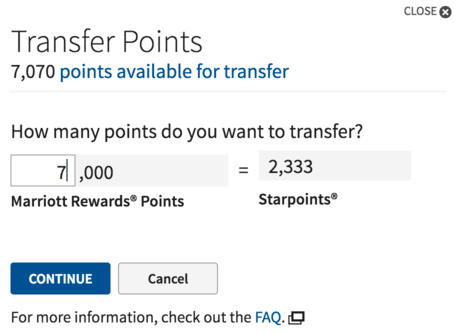

Amex Starwood Preferred Guest (35,000 Starpoints) – This is the current and highest ever SPG offer that requires just $3,000 in spending (or $5k for the business version), up from the more typical 25k offer.

Amex EveryDay Preferred (50,000 Membership Rewards points) – There’s a targeted offer of 50k points for spending just $2k in three months, which is pretty fantastic. A typical good offer is 30k, with 15k being the basic public offer.

Source

Amex EveryDay Card (35,000 Membership Rewards points) – A targeted offer went as high as 35k MR points for an easy $1k in spend. The best public offer is/was 25k for spending $2k in three months, with a 15k offer sometimes available above the typical 10k offer.

Source

Source

Amex Blue Cash Everyday ($500) – The $500 offer was supposedly the highest bonus ever extended to customers, and required $3,000 in purchases in 3 months. There is currently a $300 sign-up bonus, but it’s misleading because it’s just up to that amount based on spending in the restaurant category at 10% back. The typical sign-up offer is just $100, though $250 has been offered as well.

Source

Amex Blue Cash Preferred ($250) – The highest offer was $250 for spending just $1k in 3 months, which is strangely lower than the fee-free version of this card, so take that other one with a grain of salt. The typical offer is just $150 for spending $1k.

Source

Amex Platinum Delta SkyMiles Credit Card (70,000 SkyMiles) – The highest offer was 70k SkyMiles for spending just $2k in 3 months, which is double the 35k public offer currently available. Sometimes there’s also a 60k offer, so keep your eyes peeled.

Source

Amex Gold Delta SkyMiles Credit Card (70,000 SkyMiles) – The best offer was apparently 70k SkyMiles and a $100 statement credit for spending (probably) a mere $2k in 3 months. The standard deal is 30k SkyMiles for $1k in spend, but 50k + a $50 statement credit and 60k deals pop up now and again, and may be accessed via dummy bookings on Delta.com.

Source

Bank of America

BankAmericard Cash Rewards Credit Card ($200) – The best offer was $200 after spending just $500 in the first 90 days, double the typical $100 sign-up bonus.

Bank of America Cash Rewards for Business MasterCard ($500) – The highest offer is/was $500 in cash for spending a quite high $5,000 in the first 60 days, more than double the standard $200 statement credit sign-up bonus for just $500 in spending.

Source

BankAmericard Travel Rewards Credit Card (20,000 points) – The highest offer is 20,000 points after spending $1,000 in the first 90 days, double the typical 10,000-point sign-up bonus.

Barclaycard

Barclaycard Arrival Plus (50,000 miles) – You can still get your hands on this best-ever offer of 50k points after spending $3,000 in 3 months. Use the points to offset $500 in travel purchases…instead of the typical 40k offer.

Barclaycard CashForward World MasterCard ($200) – There is a targeted $200 offer after spending $500 in 3 months. This is double the public $100 offer for the same spending.

Source

Barclaycard Hawaiian Airlines World Elite MasterCard (50,000 Hawaiian miles) – There is a 50k mile offer available after spending $1,000 in 90 days that you can get by flying Hawaiian or by doing a dummy booking on their website. This is 15k more than the 35k public offer for the same spending.

Source

Capital One

Capital One Quicksilver ($200) – The best offer to date is $200 for spending $1,000, but it’s targeted. The typical offer is $100 for spending $500 in the first three months.

Source

Capital One Venture Rewards (100,000 miles) – There was an odd sign-up bonus back in 2012 where they agreed to double what you spent on a competing travel credit card the previous year. The best normal sign-up bonus was 50k, and is now 40k for spending $3k in 3 months.

Source

Chase

Chase Ink Cash ($500 or 50,000 Ultimate Rewards points) – This is available March 12th, 2017 and is the highest bonus ever offered on the card. You get $500 or 50k UR points once you spend $3,000 in 3 months, up from the standard $200 or $300 typically offered.

Source

Chase Ink Preferred (100,000 Ultimate Rewards points) – This is a rumored, yet-to-be-released highest sign-up bonus ever. It’s currently publicly available at 80k after spending $5k in 3 months. Apparently this will be targeted.

Source

Chase Sapphire Preferred (80,000 Ultimate Rewards points) – A public offer (available as of late 2020) that requires just $4,000 in spend during first three months for 80k UR points is the highest ever offered on this card. A $95 annual fee the first year does apply.

Source: Chase website

Chase Sapphire Reserve (100,000 Ultimate Rewards points) – This was the original offer tied to the card, which Chase has since slashed in half to 50k unless you apply in-branch by early March 2017. The spending requirement has always been $4,000 in the first three months with a $450 annual fee.

Chase Freedom ($300) – The highest bonus ever was $300, or 30k UR points, for spending just $500 in 3 months. That’s double the typical $150 bonus.

Southwest Plus Credit Card (50,000 points) – The best and consistently available offer on this card is 50k points for $2k spend in 3 months. A much lower 25k offer is sometimes the best available, meaning you should probably wait to apply if that’s the case.

Source

Southwest Premier Business (70,000 points) – The best ever offer was 70k points for $3k spend in 3 months, but that was extremely targeted. A slightly lower 60k offer is better than the usual 50k offer that floats around.

Source

Southwest Premier Personal (50,000 points) – The personal version topped out at 50k points for $2k spend in 3 months to the best of our knowledge, but can be as low as 10k with a $200 statement credit. Or simply 25k.

Source

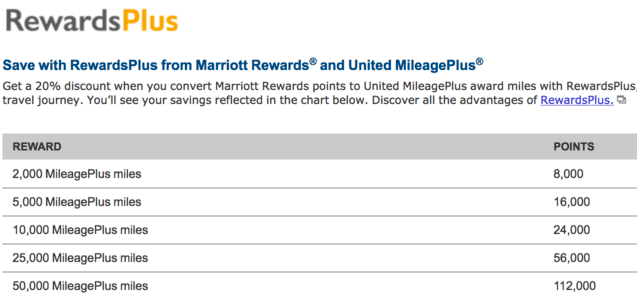

United MileagePlus Club (75,000 United miles) – The highest ever offer for this rather expensive card is/was 75k for $3k in spending. It’s targeted and you can see if you’re eligible by logging into your United account and/or getting a mailer. The usual sign-up bonus is simply a waived $450 annual fee.

Source

United MileagePlus Explorer Business Card (70,000 United miles) – The highest ever offer for this business card (and non-biz version) is/was 70,000 United MileagePlus miles for spending $3k in 3 months. You might be able to get it if you log-in to your United.com account and check for offers. Typically it’s just 50k, or as low as 30k at its worst.

Source

Marriott Rewards Premier Business (100,000 Marriott Rewards points) – The highest ever offer was 100,000 Marriott Rewards points for spending $5k in three months. It’s typically half that, though there is an 80k offer out there as well.

Source

Marriott Rewards Credit Card (100,000 Marriott Rewards points) – The highest ever offer is/was 100,000 Marriott Rewards points for spending $5k in three months. It’s typically between 50k and 80k. Don’t fall for the 150k offer that requires a massive $30k in spending.

Source

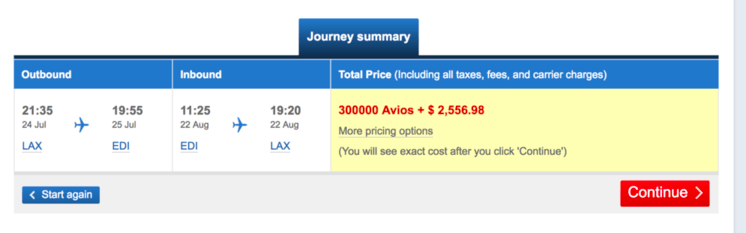

British Airways Visa Signature Card (100,000 Avios) – The best offer ever was 100,000 Avios for spending we believe just $3k in three months. They later offered the same bonus for $20k in spending. The typical deal is 50k Avios for $3k in spend.

Source

Citi

Citi ThankYou Premier (60,000 ThankYou Points) – The highest offer was 60k TYP for $3,500 in spending in 3 months, but has since been halved to 30k. Boo.

Source

Citi ThankYou Preferred (40,000 ThankYou Points) – The highest offer ever was 40k TYP for $6,000 in spending in the 12 months, but you’re more likely to see the 15k-point offer for $1k spend in 3 months.

Source

Citi Prestige (100,000 ThankYou Points) – The highest offer ever was 100k TYP, which was targeted, but has since been downgraded to just 40k. But be on the lookout for an improved offer, as 60k has also been offered in the past.

Source

Citi / AAdvantage Executive World Elite MasterCard (100,000 AA miles) – The highest sign-up bonus on this card was 100,000 AA miles for spending $10k in three months. A more typical offer is 50k miles for spending $5,000 over the same period. Just watch out for the $450 annual fee…

Source

CitiBusiness / AAdvantage Platinum Select World MasterCard (50,000 AA miles) – The best sign-up bonus on this card is/was 50,000 AA miles for spending $3k in three months. The average offer is 30k miles for spending the same amount over the same period.

Source

Citi / AAdvantage Platinum Select World Elite MasterCard (50,000 AA miles) – This card also has/had a best-ever sign-up bonus of 50,000 AA miles for spending $3k in three months. The average offer is 30k miles for spending the same amount over the same period. The sweetest offer came with 2 Admirals Club Passes to boot!

Source

Citi / AAdvantage Gold World Elite MasterCard (50,000 AA miles) – This perhaps lesser-known Citi AA card has/had a targeted sign-up bonus of 50,000 AA miles for spending $3k in three months for 40k miles and another 10k miles if/when you spent/spend a total of $5k in first 12 months . The average offer is 25k miles for spending a very reasonable $750 in 3 months.

Source

City National

City National Crystal Infinite (100,000 points) – This in-branch offer, which has since been halved, was available in 2015 and required just $5,000 in spending during the first 90 days. Those points could be redeemed for $1,000 gift card too…

Source

Discover

Discover it ($150) – Best offer ever was $150 cash back for spending $750 in first 3 months. Today, you’re looking at $100 at best. At one point, there was a rather bogus deal that required $1,500 in monthly spending for five months to snag $200…awful.

Source

Discover it Chrome ($100 Amazon gift card) – This limited time offer in 2014 provided a $100 Amazon gift card simply for making a purchase within three months. Today, it’s $50 via referral.

Source

Discover it Miles (Double miles first year) – There is no-sign up per se, but they do give you an effective cash back rate of 3% the first year.

Merrill Lynch

Merrill + Visa Signature Credit Card (50,000 Merrill Points) – This card affords 50,000 points after spending $3,000 in 90 days, which is the current and highest offer.

Source

Wells Fargo

Wells Fargo Propel 365 Amex (20,000 points) – The highest bonus on this card is/was 20,000 points for spending $3,000 in the first three months.

Wells Fargo Propel World Amex (40,000 points) – The highest ever bonus is/was 40k points for spending $3k in 3 months, but it is now only available via branch. Not sure if it’s coming back to the internet…

(photo: Susanne Nilsson)